Offset accounts

The number 1 home loan feature I am asked for is an offset account, most of my customers have heard that they are a great way to save money on their home loans.

- So what are they?

- How do they work?

- And will they save you money?

An offset account is a transaction account that is attached to a home loan. The balance of this account is calculated on a daily basis and is then used to ‘offset’ interest against your home loan.

Eg – if you had a home loan for $100,000 and an offset account with $10,000 you would only be charged interest on the remaining $90K. Your repayments will generally stay the same allowing your home loan to be paid off sooner.

In principal this seems like a great way to save money on your home loan, however there are a few caveats that mean they are not always right for everyone.

How much money could you save with an offset?

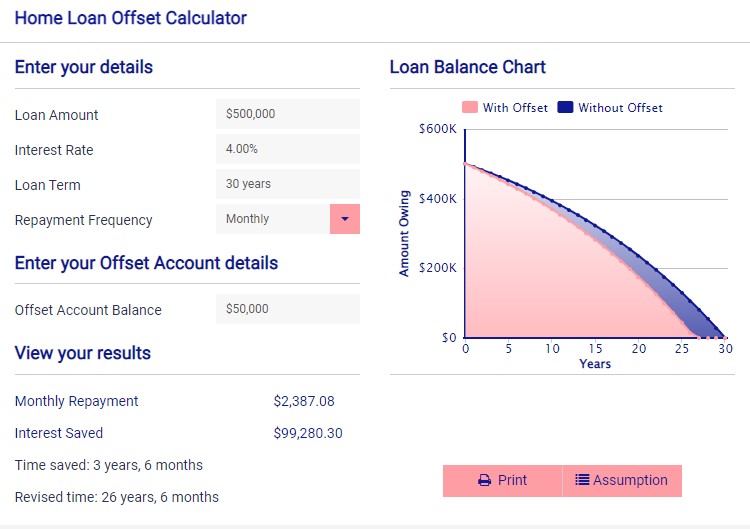

Using our free calculator you can easily work out how much you could potentially save with an offset account.

In the example below we have a typical $500,000 mortgage at 4% over 30 years. With a $50,000 offset you could save nearly $100,000 in interest and shave 3.5 years off your loan length.